|

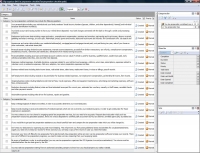

Task Management Software |

|

|

|

|

|

| |

|

TESTIMONIALS TESTIMONIALS

|

|

"...This is an excellent program. I'm so glad that I stumbled on to this when researching for task management programs. Very low learning curv, quite flexible, and the price is right. Tried at least 20 other programs, either too complicated, too expensive, or poor documentation..."

Chad Lindsey -

Honolulu, HI

|

|

|

|

|

|

|

|

Tax preparation checklist |

|

|

|

|

|

|

|

This tax preparation checklist will be helpful to everyone who is a beginner in tax payment and would like to clarify what taxes information is and how they should be prepared. This is a guide which gives you a vision of things you need to consider. Unfortunately it is just impossible to create a complete tutorial due to differences of fiscal systems in different countries, but with a help of this checklist you can get some useful recommendations and tips, specifically for US.

|

| Order 750 checklists in MS Word and PDF printable format at $49.99 USD only. |

BUY NOW!  |

Your worksheet may include the following positions:

- Your personal data including your individual and your family members’ Social Security Numbers (spouse, children, and other dependents). Name(s) and individual taxpayer identification number(s).

- Your bank account and routing number to have your refund direct deposited. Your bank charges connected with the bank or through a credit card processing company.

- Employment and income data including wages and salary, unemployment compensation, pensions and annuities, partnership and trust income, alimony received, gambling and lottery winnings, jury duty pay, fellowships, prizes, grants and awards, state and local income tax refunds. IRA Contribution Info. Job search and moving related expenses.

- Homeowner and renter data including your residential address(es), mortgage/second mortgage interest paid, rent paid during tax year, sale of your house or other real estate, real estate taxes paid.

- Financial assets including dividend income statements, interest income statements, proceeds from broker transactions, tax refunds, unemployment compensation, miscellaneous income, retirement plan distribution, distributions from medical savings accounts.

- Financial liabilities including auto loans and leases (account numbers and car value) if vehicle is used for business, qualified tuition, student loan paid, early withdrawal penalties (CDs IRAs, etc) and other time deposits.

- Expenses: medical expenses, charitable donations, expenses related to your job like travel expenses, uniforms, union dues, subscriptions, expenses related to volunteer work, investments expenses, child care, adoption, tax return preparation expenses and fees.

- Business-related taxes including state income taxes, real estate taxes, sales taxes, employment taxes, invoices or billings, payroll records.

- Self-employment data including receipts or documentation for business-related expenses, non-employment compensation, partnership SE income, farm income.

- Ongoing business costs including telephone and Internet fees, travel expenses, office and equipment maintenance, advertising and marketing expenses, software fees, rental payments.

- Deduction documents including federal, state and local estimated taxes paid for current year, estimated tax vouchers, casualty or theft losses, cancelled checks and other payment records.

- Automobile expenses including miles driven for business, repairs and gasoline.

Tax preparation tips:

- Keep a mileage logbook of distance travelled, in order to accurately determine your travel deduction.

- Keep records including invoices and statements of medical expenses which are not covered by your medical insurance, in order to get a deduction for those expenses on assessment.

- You may outsource your tax chores by engaging special services, but you need to be accurate. Request about education which such outsourcing specialists possess, there are various designations: certified public accountant (CPA); tax attorney; enrolled agent (EA); accredited tax preparer (ATP); accredited tax advisor (ATA).

- If you would like to get paid assistance you should carefully learn and compare the rates which you will be charged to.

- Don’t miss any deductions by organizing accurate record keeping. This will prevent you from paying additional taxes and penalties for unsubstantiated items. Legally you need only to keep tax records for three years but you can keep a copy of the returns in case you need information.

- Economize your time with filling the forms electronically (online service). Use software to keep your records. There are a lot of different programs; you need to make overview reasoning from your taxpaying needs.

- Be aware of deadlines in order to avoid penalties (you may use organizers like VIP Organizer to avoid procrastinations). Tax returns must be submitted before the due date given by the IRS.

- You may take training from an authorized consulting company to know how you should prepare your tasks in details.

| Order 750 checklists in MS Word and PDF printable format at $49.99 USD only. |

BUY NOW!  |

|

|

CentriQS Tasks Management Solution

Looking for multi-user task management software? Try CentriQS complete task management solution for planning, tracking and reporting tasks, projects, and schedules. Increase productivity of your small business or office by better organizing your employees' tasks and time.

FREE Download CentriQS FREE Download CentriQS

|

|

|

|

|

|

|

|

|

|

CentriQS  -15% OFF -15% OFF |

All-in-one business management software

for small and midsize enterprises |

|

|

|

| VIP Task Manager |

Multi-user project management software

to plan, schedule and track project tasks. |

|

|

|

| VIP Checklists

|

More than 750 ready-to-use to-do lists

to plan your personal and business life |

|

|

|

| VIP Team To Do List |

Professional task management software

to make and send team todo lists by email |

|

|

|

| VIP Organizer |

Personal time management software

to organize time at home and at work |

|

|

|

| VIP Simple To Do List

|

Simple and effective to-do list software

to plan daily chores, trips, wedding, etc. |

|

|

|

|

|

|

|

|